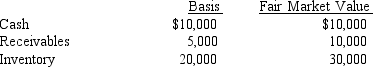

The Dominguez Partnership has the following assets on December 31:  Antonio is a 20 percent partner and has a $7,000 basis in his partnership interest. The partnership has no liabilities. Antonio receives a liquidating distribution of $10,000 cash. What is the amount and character of the gain or income Antonio recognizes on this liquidating distribution?

Antonio is a 20 percent partner and has a $7,000 basis in his partnership interest. The partnership has no liabilities. Antonio receives a liquidating distribution of $10,000 cash. What is the amount and character of the gain or income Antonio recognizes on this liquidating distribution?

A) 0

B) $1,000

C) $2,000

D) $3,000

Correct Answer:

Verified

Q36: Ray, Ronnie and Joe are partners in

Q37: Ray, Ronnie and Joe are partners in

Q43: When does a partner recognize gain on

Q54: Noah, a partner in the LMN Partnership,

Q57: Logan's basis in his partnership interest is

Q61: If a shareholder does not have sufficient

Q64: An S election terminates

A)when a shareholder dies.

B)when

Q66: Which of the following does not affect

Q70: Which of the following statements does not

Q103: Sarah is a 25% partner in a

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents