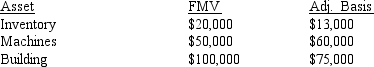

What is Alexander's net gain or loss on the liquidation of his 100 percent interest in an S corporation if the corporation distributes the following three assets to him in exchange for his stock:  Prior to any distributions, Alexander's basis in his S corporation interest was $160,000.

Prior to any distributions, Alexander's basis in his S corporation interest was $160,000.

A) ($12,000)

B) ($22,000)

C) $10,000

D) $22,000

Correct Answer:

Verified

Q53: Calvin sells his 40 percent interest in

Q62: The S corporation income tax return includes

Q63: Which of the following is not a

Q65: Corbin has a $15,000 basis in his

Q67: Which of the following may not be

Q73: Duet Co.is a calendar year S Corporation

Q75: Greg and Samantha plan to establish a

Q77: Jonathan's basis in his S corporation stock

Q79: The accumulated adjustment account

A)is a shareholder account.

B)can

Q122: Jared owns 50% of an S corporation's

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents