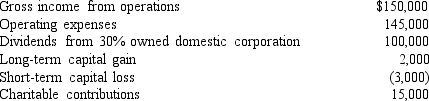

Monroe Corporation reported the following results for the current year:  Included in the above is $5,000 of qualified production activities income. In addition, Monroe Corporation has a $5,000 NOL carryforward from last year. How much can Monroe Corporation take as a charitable contribution deduction in the current year?

Included in the above is $5,000 of qualified production activities income. In addition, Monroe Corporation has a $5,000 NOL carryforward from last year. How much can Monroe Corporation take as a charitable contribution deduction in the current year?

A) $15,000

B) $10,500

C) $10,000

D) $5,000

Correct Answer:

Verified

Q25: What is Gigantic Corporation's net tax liability

Q37: Whyley Corporation, a C corporation, has gross

Q39: Marlin Inc., a calendar-year corporation, has gross

Q46: Ponoco Corporation, which has current earnings and

Q56: Which of the following is not a

Q58: Soledad received one stock right for every

Q65: A corporation has a July 30 year

Q66: Alpha Corporation's adjusted taxable income is $100,000

Q68: Monroe Corporation reported the following results for

Q75: Cloud Corporation has a taxable income of

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents