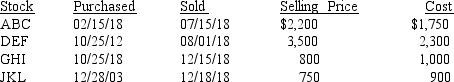

In 2018, Isabella sold several shares of different stocks held for investment. The following is a summary of her capital transactions for the year:  What is the amount of Isabella's net capital gains or losses for 2018?

What is the amount of Isabella's net capital gains or losses for 2018?

A) $1,300 long-term capital gain

B) $850 long-term capital gain and $450 short-term capital gain

C) $1,050 long-term capital loss and $250 short-term capital loss

D) $1,050 long-term capital gain and $250 short-term capital gain

Correct Answer:

Verified

Q26: Edna had $20,000 of ordinary income.In addition,

Q29: On March 17, a calendar-year taxpayer sells

Q30: Brent sold his personal car and some

Q33: Cliff owned investment stock purchased three years

Q37: What are the carryover provisions for unused

Q49: Alpha Corporation had income from operations of

Q50: Vero Corporation owns $200,000 of equipment used

Q54: During the current year, Mrs.Mayhew received a

Q58: Which of the following is correct?

A)The Section

Q74: Carol used her auto 60 percent for

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents