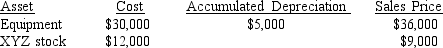

Ethan, a sole proprietor, sold the following assets in 2018:  The equipment was purchased several years ago but the XYZ stock was purchased as an investment on 3/9/18 and was sold on 11/15/18. Ethan is in the 32% marginal tax bracket for 2018. At the beginning of 2018, he had $2,000 of unrecaptured Section 1231 losses from 2 years ago. How much additional tax will Ethan pay as a result of these transactions?

The equipment was purchased several years ago but the XYZ stock was purchased as an investment on 3/9/18 and was sold on 11/15/18. Ethan is in the 32% marginal tax bracket for 2018. At the beginning of 2018, he had $2,000 of unrecaptured Section 1231 losses from 2 years ago. How much additional tax will Ethan pay as a result of these transactions?

A) $1,200

B) $1,650

C) $2,390

D) $2,640

Correct Answer:

Verified

Q22: Coley Corporation has an $800 net short-term

Q26: Edna had $20,000 of ordinary income.In addition,

Q29: On March 17, a calendar-year taxpayer sells

Q32: Sheldon had salary income of $40,000.In addition,

Q33: Cliff owned investment stock purchased three years

Q38: Lopez Corporation sold equipment that it had

Q40: Mason received $20,000 cash and equipment worth

Q50: Vero Corporation owns $200,000 of equipment used

Q66: During the current year, Zach had taxable

Q68: Identify the type(s) of gain or loss

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents