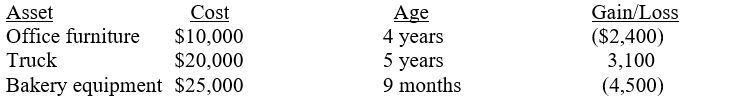

Angel sells the following depreciable assets from her sole proprietorship:

What should Angel report on her income tax return relative to each of these property transactions?

A) $3,800 capital loss

B) $3,100 Section 1245 recapture; $2,400 Section 1231 loss; $4,500 ordinary loss

C) $3,800 ordinary loss

D) $700 Section 1231 gain; $4,500 ordinary loss

Correct Answer:

Verified

Q46: Lopez Corporation sold equipment that it had

Q47: Paul has a $45,000 net Section 1231

Q48: Lopez Corporation sold equipment that it had

Q49: Alpha Corporation had income from operations of

Q50: Vero Corporation owns $200,000 of equipment used

Q52: During the current tax year, the Jeckel

Q53: Caldwell Corporation sold a factory building for

Q54: During the current year, Mrs.Mayhew received a

Q55: Quidik Corporation sold a machine for $80,000

Q56: Kevin owns a rental apartment building that

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents