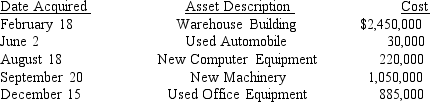

Sanjuro Corporation (a calendar-year corporation) purchased and placed in service the following assets during 2018:  All assets are used 100% for business use. The warehouse building does not include the cost of the land on which it is located which was an additional $1,000,000. The corporation has $3,000,000 income from operations before calculating depreciation deductions. Sanjuro Corporation made whatever elections were necessary to maximize its overall depreciation deduction for 2018. To maximize its total cost recovery deduction, what was Sanjuro Corporation's cost recovery deduction for the used office equipment for 2018?

All assets are used 100% for business use. The warehouse building does not include the cost of the land on which it is located which was an additional $1,000,000. The corporation has $3,000,000 income from operations before calculating depreciation deductions. Sanjuro Corporation made whatever elections were necessary to maximize its overall depreciation deduction for 2018. To maximize its total cost recovery deduction, what was Sanjuro Corporation's cost recovery deduction for the used office equipment for 2018?

A) $2,185,000

B) $1,000,000

C) $885,000

D) $442,500

Correct Answer:

Verified

Q27: The first and last years of MACRS

Q28: Lopez Corporation is a calendar-year taxpayer.What is

Q57: Conrad Corporation has a June 30 year

Q58: All of the following are acceptable conventions

Q77: During the year, Garbin Corporation (a calendar-year

Q82: Chipper, a calendar-year corporation, purchased new machinery

Q83: Rodriguez Corporation acquired 7-year property costing $450,000

Q84: On November 7, 2018, Wilson Corporation, a

Q85: Sanjuro Corporation (a calendar-year corporation) purchased and

Q86: On June 20, 2018 Baker Corporation (a

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents