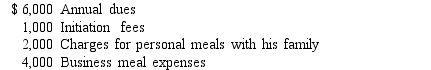

Jordan is a self-employed tax attorney who frequently entertains his clients at his country club. Jordan's club expenses include the following:  How much can Jordan deduct?

How much can Jordan deduct?

A) $2,000

B) $5,000

C) $8,000

D) $9,000

Correct Answer:

Verified

Q41: Cailey incurs $3,600 for business meals while

Q47: Gigi's legal expenses for the year included

Q51: Deductible home office expenses include the following

Q57: Which of the following would not be

Q59: All of the following expenses are deductible

Q90: Fabricio, Inc. is an accrual-basis corporation. It

Q92: Waldo bought two tickets for a Packers

Q96: Donald, a sole proprietor, worked in Chicago

Q98: In 2017, Jasmin loaned her friend Janelle

Q100: Andrew's hobby is painting. During 2018, Andrew

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents