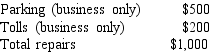

Haley, a self-employed individual, drove her automobile a total of 20,000 business miles in 2018. This represents about 75% of the auto's use. She has receipts as follows:  If Haley uses the standard mileage rate method, how much can she deduct as a business expense?

If Haley uses the standard mileage rate method, how much can she deduct as a business expense?

A) $12,500

B) $11,600

C) $11,200

D) $11,000

Correct Answer:

Verified

Q33: A taxpayer may deduct a fine for

Q39: Carlos, a self-employed construction contractor, contributed $5,000

Q40: John, a rental car dealer on Miami

Q42: Nick owns a home in Daytona Beach,

Q43: Tom flew to Madrid on Wednesday; he

Q44: Isabel owns a vacation home in Hawaii.During

Q54: Which of the following business expenses is

Q55: Corinne's primary business is writing music.She uses

Q81: Bob works for Brandon Corporation. Brandon reimburses

Q88: Nicholas wanted to take an important customer

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents