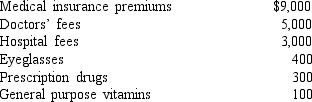

Camila, age 60, is single and has adjusted gross income of $100,000. She paid (with after-tax dollars) the following medical expenses in 2018:  She received only $2,000 in reimbursements from her insurance company for her medical expenses. How much can Camila deduct for medical expenses in 2018 if she has $30,000 of other itemized deductions?

She received only $2,000 in reimbursements from her insurance company for her medical expenses. How much can Camila deduct for medical expenses in 2018 if she has $30,000 of other itemized deductions?

A) $8,200

B) $8,300

C) $5,800

D) $5,700

Correct Answer:

Verified

Q63: All of the following are qualifying relatives

Q80: Justin, age 42 and divorced, is the

Q86: In 2018, Carol, who is 54 and

Q87: Vera and Jake (both age 45) are

Q88: To qualify as a dependent, most individuals

Q89: Patricia's AGI was $80,000 in both 2017

Q91: Amelia, an accountant, normally bills her clients

Q92: Colin (age 40) is single and itemizes

Q94: Emma purchased investment land in 2012 for

Q95: Colin (single and age 40) has AGI

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents