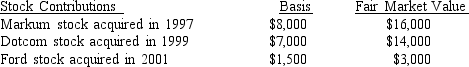

What is Beth's maximum allowable deduction for the following contributions to qualified public charities during the current year if her adjusted gross income is $90,000?

A) $45,000

B) $33,000

C) $27,000

D) $16,500

Correct Answer:

Verified

Q45: Which of the following is true regarding

Q67: All of the following are a common

Q76: Susan pays $4,700 for daycare for her

Q80: Justin, age 42 and divorced, is the

Q91: Amelia, an accountant, normally bills her clients

Q92: Colin (age 40) is single and itemizes

Q94: Emma purchased investment land in 2012 for

Q95: Colin (single and age 40) has AGI

Q97: Cleo's husband died in January of 2016.

Q100: John and Mary have three children: Aaron

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents