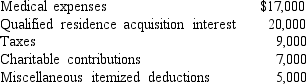

Samuel, a single individual, has adjusted gross income of $150,000 and the following itemized deductions before applicable floor limitations for 2018:  What are Samuel's itemized deductions for alternative minimum tax purposes?

What are Samuel's itemized deductions for alternative minimum tax purposes?

A) $32,750

B) $20,000

C) $44,000

D) $29,000

Correct Answer:

Verified

Q71: Nonrefundable tax credits

A)allow the excess credit over

Q74: What is the difference in tax savings

Q87: All of the following are allowable deductions

Q111: Tina is 60 and single. She has

Q113: Susan (age 29) is single but has

Q114: Stephanie and Cal have three dependent children

Q115: Cliff is married and files a joint

Q116: Cailey and Dimitri are married and file

Q117: Cindy has taxable income of $67,000 excluding

Q120: Maurice and Judy (both age 32) have

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents