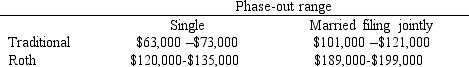

Carole, age 38, is single and works as a physical therapist. She is covered by her employer's retirement plan. What is the maximum deductible contribution she can make to a traditional IRA in 2018 if her AGI is $65,000?

AGI Phase-Out Ranges for 2018 IRAs

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q24: Which of the following is not a

Q26: Which of the following is a taxable

Q33: Wilma is CEO of and owns 100

Q35: Which of the following is not taxable

Q37: Which of the following would not be

Q40: Carol owns a small curio shop that

Q47: Which of the following statements is correct?

A)

Q53: Bill was awarded 3,000 options; each option

Q54: Warren has $62,400 of net income from

Q56: During 2018, Jackson Corporation paid Brittany a

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents