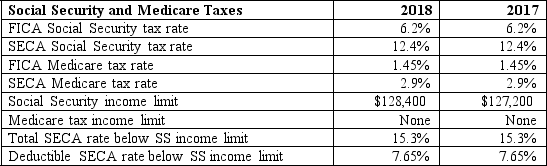

During 2018, Jones Corporation paid Joshua a salary of $100,000 and a bonus of $30,000. What is Jones Corporation's deduction (rounded to the nearest dollar) for its share of FICA taxes paid on Joshua's compensation for 2018?

A) $6,200

B) $7,961

C) $9,232

D) $9,846

Correct Answer:

Verified

Q25: All of the following expenditures qualify for

Q26: Which of the following is a taxable

Q37: Which of the following would not be

Q47: Which one of the following employee benefits

Q56: During 2018, Jackson Corporation paid Brittany a

Q56: What is a phantom stock plan?

A)A purchase

Q58: Jose worked at an architectural firm as

Q59: Taxable compensation received from a business does

Q62: In 2018 Lindsey decides she no longer

Q65: Which of the following fringe benefit does

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents