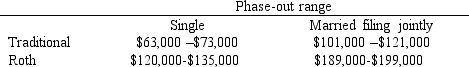

Carl, age 44, wants to contribute the maximum allowed to a Roth IRA. He is single and his AGI is $124,000. How much can he contribute to the Roth IRA?

A) $5,500

B) $4,033

C) $2,000

D) $1,467 AGI Phase-Out Ranges for 2018 IRAs

Correct Answer:

Verified

Q32: Tavis works for a company that sponsors

Q39: If an employee is reimbursed through an

Q44: Five years ago, Devin Corporation granted Laura

Q65: All of the following are retirement plans

Q76: In 2015 Martinez Corporation granted nonqualified stock

Q77: Kaylee is a member of the U.S.

Q82: During 2018, Zach has net income from

Q83: The contribution limit for a defined contribution

Q84: Megan accepts an assignment working in Germany

Q85: What is the maximum deductible contribution that

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents