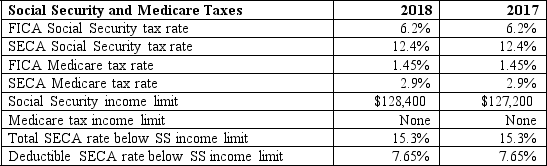

Pablo earns $85,000 from his regular job as a salesman and an additional $60,000 from his sole proprietorship in 2018. What is his self-employment tax (rounded to the nearest dollar) ?

A) $20,487.85

B) $17,980.00

C) $5,381.60

D) $6,988.49

Correct Answer:

Verified

Q49: Which type of retirement plan would not

Q54: Which of the following are characteristics of

Q55: Which type of retirement plan guarantees a

Q58: Qualified deferred compensation plans have the following

Q68: Henry is an employee of Argus Corporation.His

Q89: Tom, a calendar-year taxpayer, worked in Japan

Q92: ABC Corporation awarded John 1,000 options in

Q95: Harris Corporation granted Tyler 1,000 stock appreciation

Q96: During 2018, Kyle has net income of

Q98: ABC Corporation awarded John 1,000 options in

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents