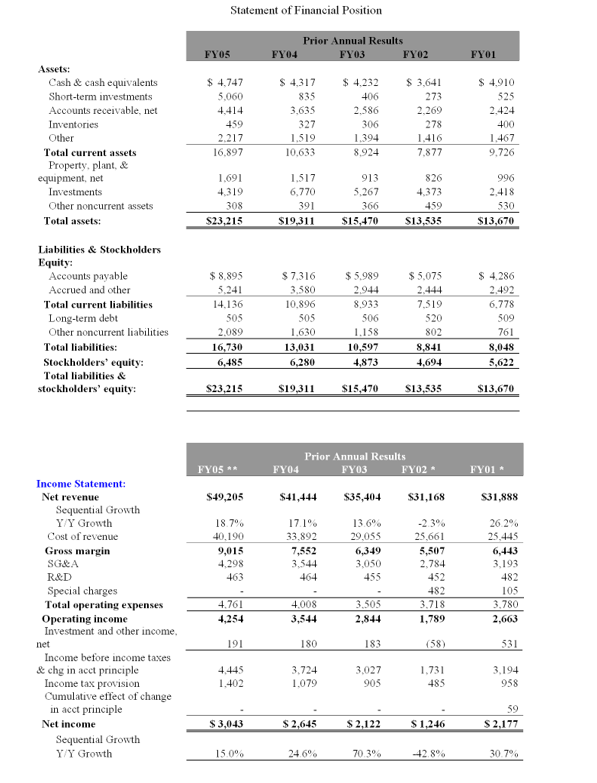

Following are Dell's condensed consolidated statement of financial position and condensed consolidated statement of operations, in millions (unaudited).

a. Assume all net revenue are from credit sales. Using the above information, calculate the following ratios for FY05 to FY02:

1. Current ratio

2. Quick ratio

3. Working capital

4. Days' sales in accounts receivable

5. Days' sales in inventory

6. Days' purchases in accounts payable

7. Net days' working capital

8. Long-term debt to assets ratio

9. Total debt-to-equity ratio

10. Total liabilities to total assets

Note: Use average inventory, average accounts receivable, and average accounts payable in the calculation of days' sales in inventory, days' sales in accounts receivable, and days' purchases in accounts payable respectively.

b. Comment on the changes to Dell's liquidity risk

c. Comment on the changes to Dell's solvency risk

Correct Answer:

Verified

Q1: Which of the following would be least

Q2: Using LIFO rather than FIFO in a

Q3: Refer to the financial statements for

Q5: Which of the following increases when accounts

Q6: Which of the following is not likely

Q7: Which of the following statements concerning the

Q8: Which of the following industries would you

Q9: Assume that Company ABC issues $20 million

Q10: Company ABC has a large, wholly owned

Q11: Indicate the effect of the following

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents