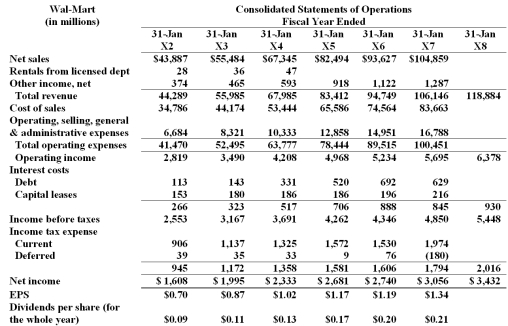

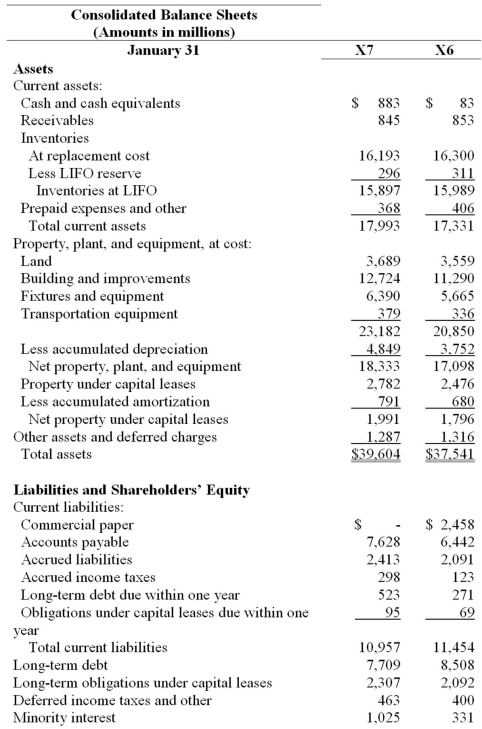

Refer to Wal-Mart's financial statements, below.

Shareholders' Equity

Shareholders' Equity

Preferred stock ( par value; 100 share authorized. none issued)

Common stock ( par value; 5.500 million shares authorized. 2,285 million and 2,293 million issued and

a. Calculate: total debt to equity ratio and times interest earned ratio for fiscal X6 and X7. Comment on your results.

b. Analysis of Wal-Mart's footnotes reveals the existence of significant operating leases. Explain whether this would change your answer in part a) and how you would make the changes.

Correct Answer:

Verified

X7

Total debt to equity = Tot...

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q12: Imagine FASB passes a new rule that

Q13: Which of the following is not likely

Q14: Selected ratios for Hurtal Corporation for

Q15: Which of the following best describes the

Q16: Which of the following is not a

Q18: Consider each of the following situations independently

Q19: Which of the following is likely to

Q20: Which of the following items would not

Q21: Two companies, A and B, both

Q22: ABC Company is planning a major expansion

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents