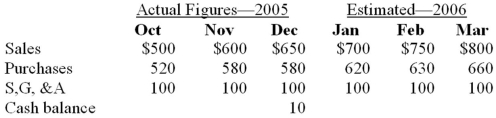

You are the treasurer of Hodgkiss Suppliers Corporation (HSC), a sporting goods equipment distributor. You are trying to determine the cash flow needs for the company for the first three months of 2006.

Other information:

• 50% of sales are on a cash basis, of the remaining 50% half is collected in the following month and the other half two months later.

• All purchases are paid for in the following month.

• Selling, general, and administrative (S, G, & A) costs are fixed, and are paid as incurred.

• Dividends payable in February are $20.

• Interest payment is due in March of $50.

• Minimum cash balance required is $10.

a. Estimate what if any, HSC requires in the way of additional external financing at the beginning of January to ensure they have enough cash to maintain a $10 cash balance through until the end of March.

b. If additional external financing is not available, name three approaches HSC might use in order to avoid the need for external financing.

Correct Answer:

Verified

Q8: The treasurer of Simmons Corporation, a

Q9: The statement of cash flows for

Q10: The statement of cash flows for

Q11: You have just prepared pro forma income

Q12: What is the correct order of the

Q14: What is the correct order of the

Q15: The reliability of short-term cash forecast depends

Q16: Other things held constant, which of the

Q17: Which of the following is the most

Q18: Yeats Corporation is trying to determine its

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents