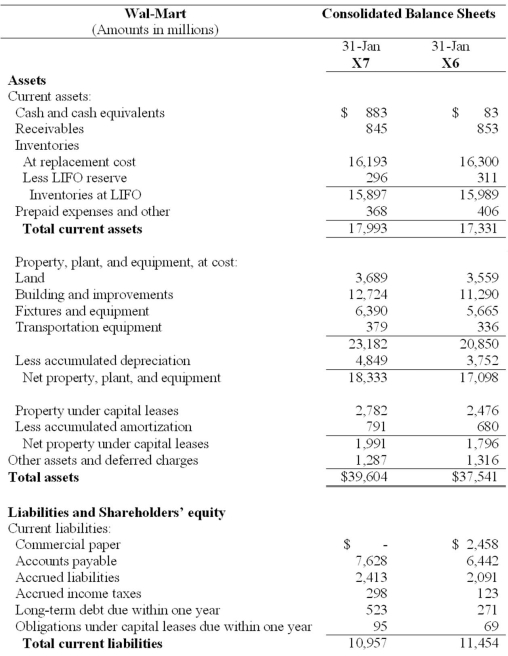

Shareholders' Equity:

Preferred Stock Par Value; 100 Shares Authorized, None Issued)

Common Stock

Shareholders' equity:

Preferred stock ( par value; 100 shares authorized, none issued)

Common stock ( par value; 5,500 shares authorized, 2,285 and

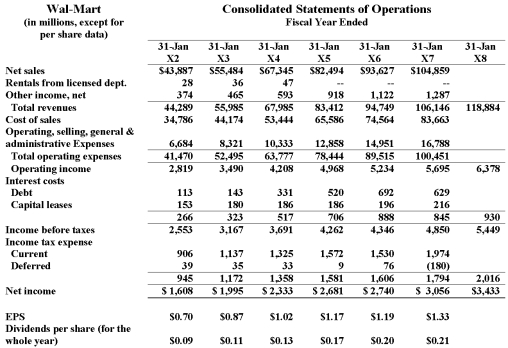

a. Calculate return on common equity (ROCE) for fiscal X4 and X7. Identify, as far as allowed by the data, components driving any changes in ROCE from X4 to X7. (If you want to give students more guidance then ask to disaggregate ROCE into net operating profit margin, net operating asset turnover and leverage.)

b. Compare and contrast the change in earnings per share to ROCE over this time period.

Correct Answer:

Verified

The ROCE has decreased. This is due i...

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q13: Which of the following statements is correct?

A)Net

Q14: Below are selected ratios for Manufacturers

Q15: Indicate the effect of the following transactions

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents