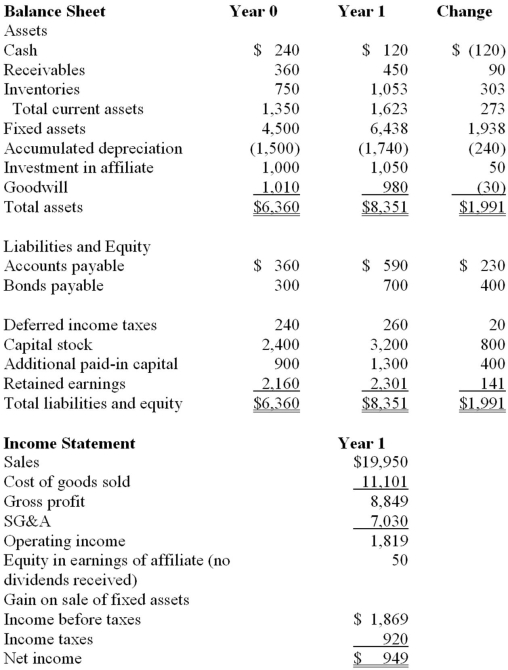

Below are the balance sheet and income statement for Anderson Corporation.

Additional Information

1. In Year 1, Anderson sold machinery bought at $36, for $18, resulting in a $2 gain on income statement.

2. $810 in dividends were paid in Year 1.

3. SG&A expense includes $50 of interest expense, and amortization expense of $30.

4. Cost of good sold includes depreciation of $260.

5. Income tax expense includes deferred tax liability of $20.

a. Prepare cash flows from operations using the direct method.

b. Prepare statement of cash flows from operations using the Indirect method.

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q6: Which of the following represents an investing

Q7: Beginning accounts receivable are $76,000. Sales for

Q8: The following information should be used

Q9: The following information should be used

Q10: Which of the following would require an

Q12: a. Is it possible to have a

Q13: Which of the following would require an

Q14: Which of the following is not a

Q15: Below is the income statement and

Q16: Use the following selected data about

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents