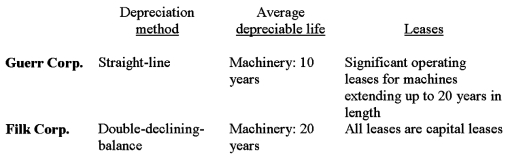

You are analyzing two companies that operate in the same industry. They are both growing capital-intensive manufacturing companies, Guerr Corp. and Filk Corp. A diligent reading of their annual reports reveals the following:

You know that these accounting differences will affect the comparability of the two company's financial results.

Consider each of the above items (depreciation method, average depreciable lives and leases) separately and determine all other things being equal, whether the following ratios will be higher, lower or the same for Guerr when compared to Filk. Explain your answers.

i. Observed price-to-earning ratio in the initial years

ii. Price-to-free cash flow in the initial years

iii. Price-to-book value in the initial years

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q7: The use of LIFO rather than FIFO

Q8: An asset is considered to be liquid

Q9: Which of the following steps is required

Q10: The following information can be found

Q11: Analysis of a company's assets will help

Q13: For Control Furniture Co., To restate

Q14: One advantage of LIFO over FIFO under

Q15: The following information can be found

Q16: You are comparing the financial statements

Q17: Which of the following is not an

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents