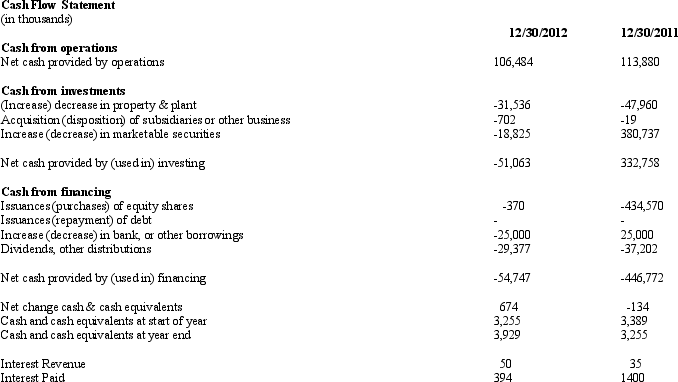

Below is information from the statement of cash flow and income statement for Garland Products, Inc. for 2012 and 2011. Marketable securities represent investments of excess cash that Garland Products does not need for operations. Garland Products' tax rate is 35%.

Using the above information calculate the amount of free cash flows to all debt and equity capital stakeholders for Garland Products for year 2012 and 2011.

Using the above information calculate the amount of free cash flows to all debt and equity capital stakeholders for Garland Products for year 2012 and 2011.

Correct Answer:

Verified

Q46: Shady Sunglasses operates retail sunglass kiosks

Q46: When should an analyst use nominal cash

Q47: Simpson Department Stores operates retail department store

Q47: Starting with free cash flows from operations,discuss

Q49: Currently,financial reporting does not take into account

Q50: Explain "free" cash flows.Describe which types of

Q50: Morgan Company reported the following items

Q51: Discuss under which scenario it is appropriate

Q53: Below is information from the statement of

Q59: Regarding the equity buyout,compute the cost of

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents