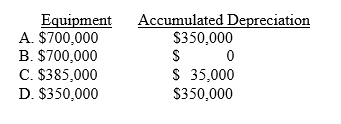

Sharp Inc. purchased equipment at a cost of $700,000 in January, 2003. As of January 1, 2012, depreciation of $315,000 had been recorded on this asset. Depreciation expense for 2012 is $35,000. After the adjustments are recorded and posted at December 31, 2013, what are the balances of Equipment and Accumulated Depreciation?

Correct Answer:

Verified

Q40: Pine Corporation makes adjusting entries monthly. As

Q41: Duck Insurance Company received advance payments from

Q42: Some of the steps in the accounting

Q43: The financial statements are prepared immediately after:

A)

Q44: Blackrock Company received a 6-month, 15% note

Q46: Buster Corporation purchased supplies at a cost

Q47: Andre's Tennis Club sells season memberships for

Q48: Staple Corp. purchased supplies at a cost

Q49: A company forgot to record four adjustments

Q50: A company forgot to record four adjustments

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents