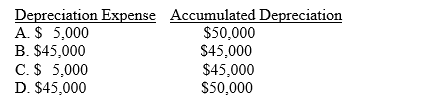

Axis Corporation purchased equipment at a cost of $100,000 in January, 2003. As of January 1, 2012, depreciation of $45,000 had been recorded on this asset. Depreciation expense for 2012 is $5,000. After the adjustments are recorded and posted at December 31, 2012, what are the balances for the Depreciation Expense and Accumulated Depreciation?

Correct Answer:

Verified

Q52: On October 1, 2012, Zane Corporation paid

Q53: Which one of the following steps in

Q54: Federer Corporation had $12,400 of supplies on

Q55: Timberland Company received advance payments from customers

Q56: On December 31, 2012, Bosco Corporation signed

Q58: Court Corporation purchased supplies at a cost

Q59: Match Incorporated recorded salary expense of $120,000

Q60: Peckham Corporation received a 9-month, 9% note

Q61: Graystone Company's plant operates five days per

Q62: Wolf Industries plant operates five days per

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents