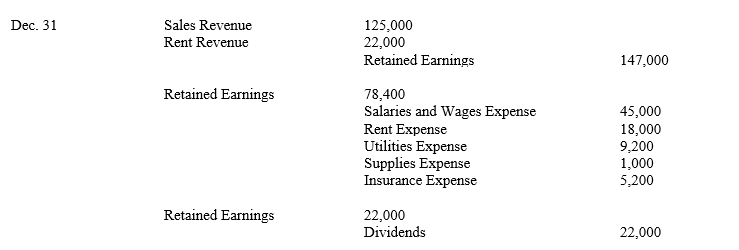

Big Dog Company began operations on January 1, 2012. The accountant for Big Dog has recorded the closing entries in the general journal at the company's year-end, December 31, 2012. In addition, the closing entries have been created in the computerized general ledger and the computer has generated a year-end trial balance. Since the closing entries have already been posted, the income statement that the computer printed has the proper account names, but all accounts have zero balances. In addition, the statement of retained earnings shows net income and dividends equal to zero instead of the correct 2012 net income and dividends. As you examine the general journal, you find the closing entries below:

In good form, prepare a statement of retained earnings for the year ended December 31, 2012. The beginning balance of retained earnings is zero.

In good form, prepare a statement of retained earnings for the year ended December 31, 2012. The beginning balance of retained earnings is zero.

Correct Answer:

Verified

Q29: _ is the allocation of the cost

Q88: The names of the four major classifications

Q91: Republic Corporation purchased supplies at a cost

Q93: Pickering, Inc. borrowed $500,000 from BTL Bank

Q95: Money Corporation employs 20 workers in its

Q96: Hondo Corporation began operations on December 1,

Q97: Explain the differences between the cash and

Q148: What are adjusting entries and what is

Q152: For each of the following sentences

Q213: What is the matching principle? How does

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents