Faultless, Inc.

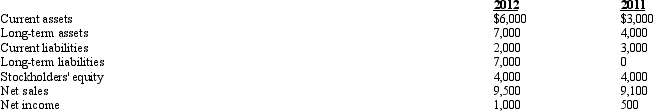

Selected data from Faultless' financial statements are provided below.

- Refer to the financial information presented for Faultless, Inc. Which of the following is true regarding the debt management ratios for Faultless between 2011 and 2012?

A) The debt to equity and debt to assets ratios both increased.

B) The debt to equity and total debt to assets ratios both decreased.

C) The debt to equity and long-term debt to equity ratios both decreased.

D) The debt to equity ratio decreased and the debt to assets ratios increased.

Correct Answer:

Verified

Q50: Opal Company purchased inventory on credit. The

Q51: Amethyst Company paid off a $100,000 two-year

Q53: The current assets of Lane Enterprises are

Q54: Sapphire Company declared and paid $1 million

Q56: If a company's current ratio is 2.2

Q57: The inventory turnover ratio is represented by

Q58: Below are selected financial data for Bouquet,

Q60: Devon Manufacturing, Inc.

The following information is

Q97: Most companies

A)agree that a current ratio of

Q98: The quick ratio differs from the current

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents