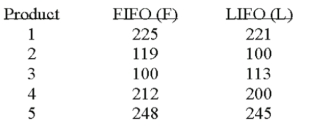

Accounting procedures allow a business to evaluate their inventory at LIFO (Last In First Out) or FIFO (First In First Out) .A manufacturer evaluated its finished goods inventory (in $ thousands) for five products both ways.Based on the following results,is LIFO more effective in keeping the value of his inventory lower?  What is the alternate hypothesis?

What is the alternate hypothesis?

A) Option A

B) Option B

C) Option C

D) Option D

Correct Answer:

Verified

Q42: A national manufacturer of ball bearings is

Q44: A national manufacturer of ball bearings is

Q45: The results of a mathematics placement exam

Q46: The results of a mathematics placement exam

Q48: A national manufacturer of ball bearings is

Q49: 20 randomly selected statistics students were given

Q49: Accounting procedures allow a business to evaluate

Q50: Accounting procedures allow a business to

Q51: A national manufacturer of ball bearings is

Q52: A national manufacturer of ball bearings

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents