The King Solomon Mining Company is contemplating a cash tender offer for the outstanding shares of Roanoke Coal Corporation. Roanoke Coal is expected to provide $162,500 in after-tax cash flow (after tax income plus CCA) each year for the next 20 years. In addition, Roanoke has a $630,000 tax loss carry-forward that King Solomon Mining can use over the next two years ($315,000 per year).

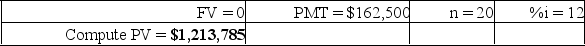

If King Solomon Mining's corporate tax rate is 34% and its cost of capital is 12%, what is the maximum cash price it should be willing to pay to acquire Roanoke?

Present value of after-tax cash flows:

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q8: Mergers often improve the financing flexibility that

Q13: Vertical integration represents acquisition of a competitor.

Q40: Following a merger, the change in the

Q75: Simon Manufacturing Co. is planning to acquire

Q77: The King Solomon Mining Company is contemplating

Q88: In light of accounting considerations,the acquiring company

Q104: List and describe nonfinancial motives for mergers.

Q105: List and describe financial motives for mergers.

Q106: Simon Manufacturing Co.is planning to acquire Garfunkel

Q107: Discuss briefly the diversification benefits and pitfalls

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents