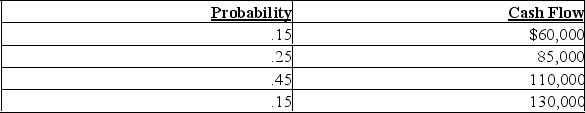

Cooper Construction is considering purchasing new, technologically advanced equipment. The equipment will cost $625,000 with a salvage value of $50,000 at the end of its useful life of 10 years. The equipment is expected to generate additional annual cash inflows with the following probabilities for the next 10 years:

A) What is the expected cash flow?

B) Cooper's cost of capital is 10%. What is the expected net present value?

C) Should Cooper buy the equipment?

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q2: As the time horizon becomes shorter, more

Q16: Decision trees present a tabular or graphical

Q24: Projects which are totally uncorrelated provide more

Q31: Sensitivity analysis helps the financial planner to

Q87: Bill Broodiest, star quarterback for the Spring

Q89: Systematic risk can be diversified away.However,unique risk

Q90: Golden Corporation is considering the purchase of

Q90: A stock with a beta of 1

Q92: To account for risk an alternative to

Q98: As the time horizon increases,the standard deviation

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents