Jury Company wants to calculate the component costs in its capital structure. Common stock currently sells for $27, and is expected to pay a dividend of $0.50. Jury's dividend growth rate is 8%, and flotation cost is $1.25. Preferred stock sells for $46, pays a dividend of $4.00, and carries a flotation cost of $1.10. Jury Company bonds yield 9% in the market. Jury is in the 40% tax bracket.

Calculate cost of debt, cost of common stock, cost of new common stock, cost of preferred stock and cost of retained earnings.

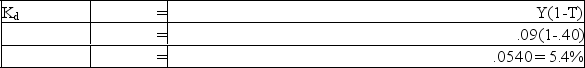

Cost of Debt (after tax)

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q124: What options do small businesses have for

Q127: A stock with a Beta of .85

Q133: The addition of bankruptcy costs in Modigliani

Q135: The market risk premium is equal to

Q138: In the Net Operating Income approach to

Q139: An increase in investors risk aversion will

Q141: The Abacus Computer Company has decided to

Q142: Jury Company has the following capital structure:

Q143: Saven Travel Corporation is considering several investment

Q145: The M&M Theory Company has an unleveraged

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents