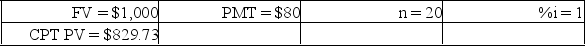

Washington Corporation has a $1,000 par value bond outstanding paying annual interest of 8%. The bond matures in 20 years. If the present yield to maturity for this bond is 10%, calculate the current price of the bond.

Correct Answer:

Verified

PV

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q101: Perot Marketing is expected to pay $2.40

Q102: The Weatherfield Way Construction Company has common

Q103: A mortgage bond is less risky than

Q105: Madison Corporation has outstanding, a $1,000 par

Q107: List and explain the factors that influence

Q109: The Nickelodeon Manufacturing Co.has a series of

Q110: The preferred stock of Gapers Inc. pays

Q112: Fullerton Company's bonds are currently selling for

Q114: If g is greater than k,the model

Q115: State Street Corp.will pay a dividend on

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents