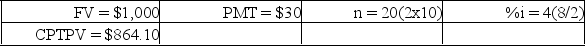

You have an opportunity to buy a $1,000 bond, which matures in 10 years. The bond pays $30 every six months. The current market interest rate is 8%. What is the most you would be willing to pay for this bond?

Correct Answer:

Verified

PV = FV *...

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q4: Higher interest rates (discount rates) reduce the

Q8: Cash flow decisions that ignore the time

Q23: Using semiannual compounding rather than annual compounding

Q30: The farther into the future any given

Q38: When the inflation rate is zero, the

Q40: Pension fund retirement accounts use the present

Q87: Marcia Stubern is planning for her golden

Q89: The Swell Computer Company has developed a

Q91: In January, Harold Black bought 100 shares

Q96: What is the difference between a nominal

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents