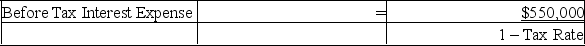

Blink and Wink (BW) manufactures contact lens. In its most recent fiscal year BW reported after-tax interest expense on a new bond issue of $550,000. If BW's effective tax rate is 35%, what was the firm's before tax interest expense?

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q134: The effective tax rate on dividend income

Q142: Calculate the tax bill for a corporation

Q143: The following is the December 31, 20X4

Q143: Valley Home Improvements (VHI)earned $350,000 after taxes

Q144: Calculate the after tax cost of the

Q146: Two-by-Four Wood Products (TBF)report net income of

Q147: Cool Ties and Things (CTT) has Total

Q148: ElectroWizard Company produces a popular video game

Q149: Jane is considering an investment in Fauna

Q150: Given the financial information for the

A.E. Neuman

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents