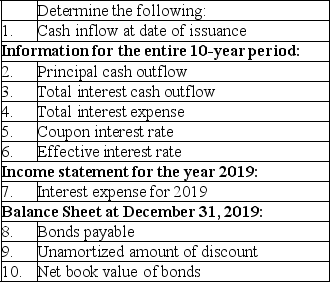

Steamboat Company issued the following ten-year bonds on January 1,2019: $100,000 maturity value,6% interest payable annually on each December 31.The bonds were dated January 1,2019 and the accounting period ends December 31.The bonds were issued for $93,000.Steamboat uses the effective-interest method for amortization.The amortization for 2019 was $510.

A.

B.Assuming instead that the accounting period ends on June 30,prepare the adjusting entry related to interest expense and the interest accrual at June 30.No adjusting entries have been made during the year.

B.Assuming instead that the accounting period ends on June 30,prepare the adjusting entry related to interest expense and the interest accrual at June 30.No adjusting entries have been made during the year.

Correct Answer:

Verified

Q107: Which of the following statements is correct?

A)An

Q108: On January 1,2019,Clintwood Company issued a $1,000,ten-year,10%

Q109: On January 1,2019,Jaspo,Inc.issued a $1,000,5%,five-year bond for

Q110: On January 1,2019,Laramie Company issued $500,000,4%,five-year bonds

Q111: A company retired $900,000 of bonds which

Q113: On March 1,2019,Halbur Company,issued $500,000 of 6%,five-year

Q114: Southridge Company prepared a bond issue dated

Q115: On January 1,2019,Simmons Company issued $100,000 of

Q116: Consider the following statement: "Issuing bonds at

Q117: On October 1,2019,Jack Company issued a $5,000,6%,bond

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents