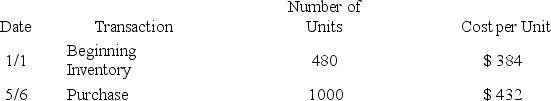

JJ Enterprises began the year with 480 units of one of its most popular products.During the year JJ purchased 1,000 units and sold 1,100 units for $500 each.What is the pre-tax effect of JJ's LIFO liquidation?

A) $38,400

B) $9,600

C) $4,800

D) $11,600

Correct Answer:

Verified

Q91: Carr Corporation has provided the following information

Q92: Cassie Corporation has provided the following information

Q93: RJ Corporation has provided the following information

Q94: On March 15,2019,Ryan Company purchased $10,000 of

Q95: RJ Corporation has provided the following information

Q97: Seattle,Co.began the year with 480 units of

Q98: Carrie Company sold merchandise with an invoice

Q99: When a company uses the periodic inventory

Q100: Which of the following costs does not

Q101: Coulter Company uses the LIFO inventory method.The

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents