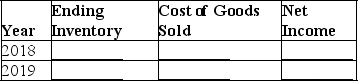

Redford Company hired a new store manager in October 2018,who determined the ending inventory on December 31,2018,to be $50,000.In March,2019,the company discovered that the December 31,2018 ending inventory should have been $58,000.The December 31,2019,inventory was correct.Ignore income taxes.

Complete the following table to show the effects of the inventory error on the four amounts listed.Give the amount of the discrepancy and indicate whether it was overstated (O),understated (U),or had no effect (N).

Correct Answer:

Verified

Q116: Of the following,which is not a control

Q117: Which of the following statements is correct?

A)Cost

Q118: Of the following,which is not a reason

Q119: Which of the following statements is correct

Q120: William Company has provided the following data:

Q122: Boulder,Inc.is computing its inventory at December 31,2019.The

Q123: Assume Webster Company buys bicycle helmets at

Q124: The inventory records of Martin Corporation reflected

Q125: The records of Atlantis Company reflected the

Q126: A.Compute the missing amounts in the income

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents