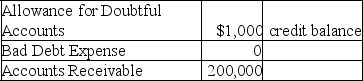

Prior to the year-end adjustment to record bad debt expense for 2019 the general ledger of Stickler Company included the following accounts and balances:

Cash collections on accounts receivable during 2019 amounted to $450,000.Sales revenue during 2019 amounted to $800,000,of which 75% was on credit,and it was estimated that 2% of these credit sales made in 2019 would ultimately become uncollectible.

Cash collections on accounts receivable during 2019 amounted to $450,000.Sales revenue during 2019 amounted to $800,000,of which 75% was on credit,and it was estimated that 2% of these credit sales made in 2019 would ultimately become uncollectible.

A.Calculate the bad debt expense for 2019.

B.Determine the adjusted 2019 year-end balance of the allowance for doubtful accounts.

C.Determine the net realizable value of accounts receivable for the December 31,2019 balance sheet.

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q96: Redwing Company sold inventory costing $500 to

Q97: Redwing Company sold inventory costing $500 to

Q98: Which of the following statements is correct?

A)A

Q99: Which of the following correctly describes the

Q100: The Ward Company has provided the following

Q102: On December 31,2019,Colonial Corporation had the following

Q103: Cyclone Inc.reported the following figures from its

Q104: A portion of the income statement for

Q105: Which of the following is not a

Q106: On January 1,American Company's allowance for doubtful

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents