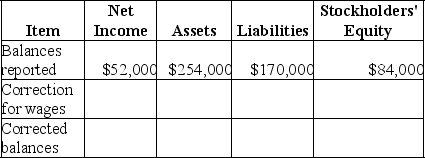

On December 31,2019,Madison Company prepared an income statement and a balance sheet.In preparing the adjusting entries at year-end,Madison failed to record the adjusting entry for wages earned by employees,but not yet paid,amounting to $5,000 for the last four days of the year.The income statement reported net income of $52,000.The balance sheet reported total assets of $254,000,total liabilities of $170,000,and stockholders' equity of $84,000.

Complete the following tabulation to show the correct amounts for the financial statements (ignore income taxes).

Correct Answer:

Verified

Q102: Which of the following correctly describes the

Q103: What is the purpose of adjusting entries?

Q104: Four transactions described below were completed during

Q105: Center Company is completing the accounting cycle

Q106: A list of the accounts of Medford

Q108: Which of the following accounts would not

Q109: On November 1,2019,Bruce Company leased some of

Q110: Below are two related transactions for Golden

Q111: On December 1,2019,Fleet Company paid $30,000 for

Q112: Which of the following is not a

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents