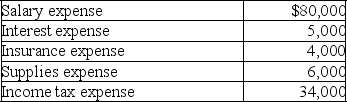

Rose Corporation began operations on January 2,2019.During 2019,Rose made cash and credit sales totaling $500,000 and collected $420,000 in cash from its customers.Rose purchased inventory costing $250,000,paid $15,000 for dividends and the cost of goods sold was $210,000.Also,the corporation incurred the following expenses during 2019:

1.Prepare an income statement showing revenues,expenses,income before income taxes,income tax expense,and net income for the year ended December 31,2019.

1.Prepare an income statement showing revenues,expenses,income before income taxes,income tax expense,and net income for the year ended December 31,2019.

2.Based on the above information,what is the amount of accounts receivable on the balance sheet prepared as of December 31,2019?

3.Based on the above information,what is the amount of retained earnings on the balance sheet prepared as of December 31,2019?

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q101: Which of the following would not be

Q102: Gail's Greenhouse,Inc. ,a small retail store that

Q103: Indicate on which financial statement you would

Q104: For Glad Rags Shops,the following information is

Q105: A new accountant who prepared the financial

Q107: Which of the following does not represent

Q108: Cosmos Corporation was established on December 31,2018,by

Q109: Which of the following is primarily responsible

Q110: Baseline Corporation was formed two years ago

Q111: Alfred Company manufactures men's clothing.During 2019,the company

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents