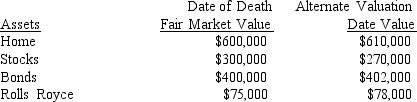

Morrow died on January 15, 2018 leaving the following assets:  What is the value of the estate if the alternative valuation date is elected and the house was sold on March 10 for $605,000 and the stocks were sold on June 30 for $265,000?

What is the value of the estate if the alternative valuation date is elected and the house was sold on March 10 for $605,000 and the stocks were sold on June 30 for $265,000?

A) $1,375,000

B) $1,360,000

C) $1,350,000

D) $1,343,000

Correct Answer:

Verified

Q41: All of the following apply to the

Q42: When Shipley died, he owned $100,000 in

Q50: The alternate valuation date is:

A)3 months after

Q54: Which of the following transfers is taxable

Q57: All of the following are deductions from

Q72: The following gifts could be subject to

Q84: Appreciated property that was inherited in 2018

A)

Q85: Glenda, age 8, has $6,150 interest from

Q92: Which of the following does not apply

Q94: Glenda, age 8, has $6,150 interest from

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents