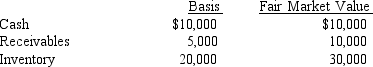

The Dominguez Partnership has the following assets on December 31:  Antonio is a 20 percent partner and has a $7,000 basis in his partnership interest. The partnership has no liabilities. Antonio receives a liquidating distribution of $10,000 cash. What is the amount and character of the gain or income Antonio recognizes on this liquidating distribution?

Antonio is a 20 percent partner and has a $7,000 basis in his partnership interest. The partnership has no liabilities. Antonio receives a liquidating distribution of $10,000 cash. What is the amount and character of the gain or income Antonio recognizes on this liquidating distribution?

A) 0

B) $1,000

C) $2,000

D) $3,000

Correct Answer:

Verified

Q24: Carol owns 40 percent of CJ Partnership.The

Q36: Ray, Ronnie and Joe are partners in

Q42: Michael was a partner in the M&M

Q43: When does a partner recognize gain on

Q48: Stewart is a 30 percent general partner

Q49: Victoria is a 50 percent partner in

Q52: Amber has a tax basis of $67,000

Q54: Noah, a partner in the LMN Partnership,

Q55: Nicole, a partner in NAB Partners, has

Q57: Logan's basis in his partnership interest is

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents