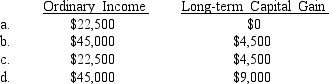

Dominguez Corporation, a calendar-year S corporation, has book income of $54,000 ($45,000 from operations and a $9,000 net long-term capital gain). During the year, Dominquez distributes $22,500 to its three equal shareholders, all of whom are calendar year taxpayers. What is the total amount of Dominguez's ordinary income and capital gains passed through to its shareholders at the end of the year?

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q68: Leo is a 50% shareholder in Small

Q69: Kevin and Jennifer are 60% and 40%

Q77: Jonathan's basis in his S corporation stock

Q81: Material participation includes all of the following

Q82: To qualify for the real property business

Q83: To qualify for the limited deduction for

Q84: Walter owns and manages his 50 percent

Q86: The passive activity loss rules apply

A)before the

Q122: Jared owns 50% of an S corporation's

Q123: For the 2018 tax year, King Corporation,

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents