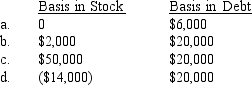

For the 2018 tax year, King Corporation, a calendar-year S corporation, had an ordinary loss from operating activities of $160,000 and a long-term capital gain from the sale of investment property of $40,000. Jordan is a 40% shareholder in King Corporation and his basis in his stock at the beginning of 2018 was $50,000. On the last day of the 2018 tax year, King Corporation's outstanding debt incurred in 2017 remains $80,000, 25 percent of which ($20,000) is owed to Jordan. What is Jordan's basis in his S corporation stock and debt on January 1, 2019?

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q53: Calvin sells his 40 percent interest in

Q68: Leo is a 50% shareholder in Small

Q69: Kevin and Jennifer are 60% and 40%

Q70: Which of the following statements does not

Q74: Which of the following is not a

Q81: Material participation includes all of the following

Q83: To qualify for the limited deduction for

Q84: Walter owns and manages his 50 percent

Q122: Jared owns 50% of an S corporation's

Q126: Dominguez Corporation, a calendar-year S corporation, has

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents