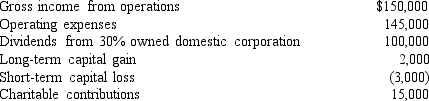

Monroe Corporation reported the following results for the current year:  Included in the above is $5,000 of qualified production activities income. In addition, Monroe Corporation has a $5,000 NOL carryforward from last year. How much can Monroe Corporation take as a charitable contribution deduction in the current year?

Included in the above is $5,000 of qualified production activities income. In addition, Monroe Corporation has a $5,000 NOL carryforward from last year. How much can Monroe Corporation take as a charitable contribution deduction in the current year?

A) $15,000

B) $10,500

C) $10,000

D) $5,000

Correct Answer:

Verified

Q23: Jude received a $25,000 distribution from BC

Q27: A corporation has pre-tax book income of

Q43: Chum Corporation distributed $20,000 cash to George,

Q49: Badluck Corporation decided to liquidate due to

Q51: Indicate by I if the following is

Q56: Which of the following is not a

Q60: Soho is a personal service corporation that

Q63: Monroe Corporation reported the following results for

Q75: Cloud Corporation has a taxable income of

Q76: BarBRanch has had taxable income of $450,000,

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents