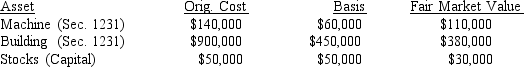

Casey Corporation has three assets when it decides to liquidate:  The corporation sells the stock for its fair market value and distributes the other two assets to its sole shareholder. What is its tax liability on its final tax return in 2018 if it had $45,000 of income from operations prior to liquidating?

The corporation sells the stock for its fair market value and distributes the other two assets to its sole shareholder. What is its tax liability on its final tax return in 2018 if it had $45,000 of income from operations prior to liquidating?

A) $6,750

B) $5,250

C) $3,750

D) $750

Correct Answer:

Verified

Q42: A sole shareholder receives a piece of

Q45: Christopher and Ashley, brother and sister, each

Q51: Maui Corporation makes two distributions during the

Q53: Walker Corporation issues one right to purchase

Q57: Maui Corporation makes two distributions during the

Q60: Molokai Corporation distributed a building valued at

Q65: What is the minimum number of individuals

Q70: A corporation is subject to both the

Q75: A corporation owns 90 percent of the

Q90: The outstanding stock of Riccardo Corporation is

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents