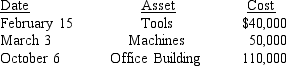

During the year, Garbin Corporation (a calendar-year corporation that manufactures furniture) purchased the following assets:  In computing depreciation of these assets, which of the following averaging conventions will be used?

In computing depreciation of these assets, which of the following averaging conventions will be used?

A) Half-year and mid-month

B) Mid-quarter and mid-month

C) Half-year, mid-quarter, and mid-month

D) Mid-quarter only

Correct Answer:

Verified

Q21: Joe started a new business this year.He

Q22: MACRS depreciation for 5-year assets is based

Q28: Lopez Corporation is a calendar-year taxpayer.What is

Q29: The adjusted basis of an asset is:

A)Its

Q30: Gonzalez Corporation is a calendar-year taxpayer.What is

Q36: The first and last years of MACRS

Q40: Jack did not depreciate one of his

Q47: Useful lives for realty include all of

Q53: The only acceptable convention for MACRS realty

Q58: All of the following are acceptable conventions

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents