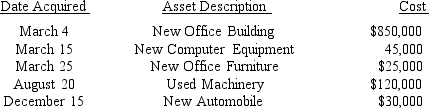

YumYum Corporation (a calendar-year corporation) moved into a new office building adjacent to its manufacturing plant in 2018. It purchased and placed in service the following assets during 2018:  All assets are used 100% for business use. The office building does not include the cost of the land on which it is located that was an additional $300,000. The corporation had $900,000 income from operations before calculating depreciation deductions. What is the maximum Section 179 deduction YumYum can claim for 2018?

All assets are used 100% for business use. The office building does not include the cost of the land on which it is located that was an additional $300,000. The corporation had $900,000 income from operations before calculating depreciation deductions. What is the maximum Section 179 deduction YumYum can claim for 2018?

A) $500,000

B) $253,160

C) $208,000

D) $25,000

Correct Answer:

Verified

Q78: Research and experimentation expenditures can be:

A)Expensed when

Q83: Rodriguez Corporation acquired 7-year property costing $450,000

Q94: Momee Corporation, a calendar-year corporation, bought only

Q97: YumYum Corporation (a calendar-year corporation) moved into

Q98: Sanjuro Corporation (a calendar-year corporation) purchased and

Q99: YumYum Corporation (a calendar-year corporation) moved into

Q101: On June, 20, 2018, Simon Corporation (a

Q104: Software purchased in 2018 is eligible for

A)

Q104: Sanjuro Corporation (a calendar-year corporation) purchased and

Q112: On June, 20, 2018, Simon Corporation (a

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents