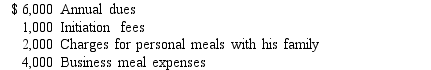

Jordan is a self-employed tax attorney who frequently entertains his clients at his country club. Jordan's club expenses include the following:  How much can Jordan deduct?

How much can Jordan deduct?

A) $2,000

B) $5,000

C) $8,000

D) $9,000

Correct Answer:

Verified

Q41: Cailey incurs $3,600 for business meals while

Q43: Tom flew to Madrid on Wednesday; he

Q46: Gina flew from Miami to San Diego

Q51: Deductible home office expenses include the following

Q59: All of the following expenses are deductible

Q63: A deferred tax liability

A)causes a business's effective

Q73: Ashley runs a business out of her

Q76: All of the following would normally result

Q98: In 2017, Jasmin loaned her friend Janelle

Q115: Lopez Corporation has income per books before

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents