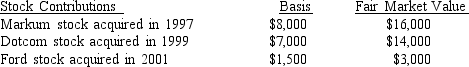

What is Beth's maximum allowable deduction for the following contributions to qualified public charities during the current year if her adjusted gross income is $90,000?

A) $45,000

B) $33,000

C) $27,000

D) $16,500

Correct Answer:

Verified

Q28: Which of the following filing statuses can

Q45: Which of the following is true regarding

Q63: All of the following are qualifying relatives

Q64: Sean bought a home in 2010 for

Q65: In 2018, which of the following is

Q80: Sebastian (age 46) and Kaitlin (age 45)

Q80: Justin, age 42 and divorced, is the

Q83: Sonjay had AGI of $60,000 in 2018

Q84: Ikito's AGI was $68,000 in 2017 and

Q88: To qualify as a dependent, most individuals

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents